2026 BRVM INVESTMENT DAYS

April 21, 2026

New York City, USA

JOIN THE 2026 BRVM INVESTMENT DAYS

The BRVM Investment Days 2026 will convene policymakers, investors, and business leaders for a high-level dialogue on investment opportunities across West Africa’s integrated WAEMU economies.

Hosted in New York City on April 21, 2026, this exclusive event will spotlight the region’s dynamic growth, deepening capital markets, and the BRVM’s pivotal role as the gateway to regional investment.

The Roadshow offers a unique opportunity to meet with WAEMU authorities, the BRVM, its listed companies, and key financial institutions, providing valuable insights into one of Africa’s most promising markets.

EXPLORE FINANCIAL OPPORTUNITIES IN WEST AFRICA AND NETWORK WITH THE BRVM

Agenda at a Glance

Investment Conference: Connecting Global Capital with West Africa’s Markets

Venue: Nasdaq MarketSite, 151 West 43rd Street, 10th Floor, New York, NY 10036

Time: 9 a.m. – 4 p.m.

This exclusive, invitation-only conference will highlight macroeconomic trends, capital-raising strategies, and key sectors driving growth across the WAEMU region.

Private meetings with regional authorities, listed companies, and financial institutions will offer unique opportunities for direct engagement and partnership.

Panel Discussions:

- WAEMU Economic Outlook – Integration, Industrialization & Investment Opportunities

- How Global Investors Evaluate WAEMU Sovereign and Corporate Risk

- Sectors Driving Growth – Energy, Agriculture & Digital Transformation

- Capital Markets & Financial Innovation – Green Finance & Infrastructure Instruments

- Investor Perspectives: What U.S. Capital Needs to See from WAEMU

- Long-Term Financing in Africa – DFIs, Development Banks & Capital Markets

Who Should Attend?

Institutional investors

Investment advisors

Corporate advisors and bankers

Academic researchers

Political and economic decision makers

Diaspora

SPOTLIGHT ON SENEGAL

Guest Country Senegal combines institutional stability, solid fundamentals, and an ambitious reform agenda.

As a WAEMU financial hub, Dakar strengthens regional capital markets through regular BRVM issuances, while Senegal Vision 2050 and growing diaspora mobilisation position the country as a credible investment gateway to West Africa.

- Further details will be provided soon.

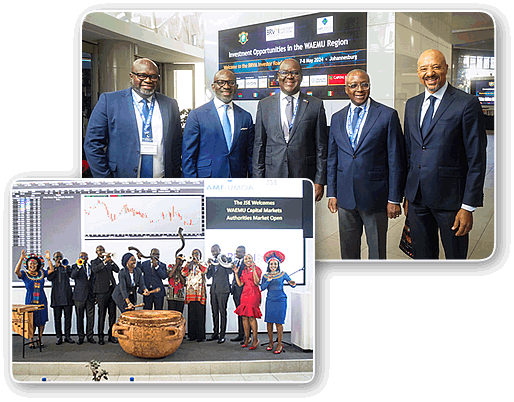

PAST EVENTS

Explore the highlights of the 2024 BRVM Investment Days in South Africa

ABOUT THE BRVM

The BRVM is a highly successful, fully integrated regional stock market. It is the only stock exchange in the world connecting eight member states in the West African Economic and Monetary Union (WAEMU) Benin, Burkina Faso, Côte d’Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo.

The BRVM is the fifth largest stock exchange in Africa with a market capitalisation of 10,078.68 billion CFA francs at the end of 2024. In just one year, it increased by 26.51% as it was 7,966.96 billion CFA at the end of 2023. The capitalisation of the bond market increased by 2.23% to 10,532.37 billion CFA francs compared to 10,302.28 billion at the end of 2024. Since its inception, the BRVM has mobilised over 21,886 billion CFA francs. Economic activity within the WAEMU remains dynamic, with value-added growth across all sectors.

Headquartered in Côte d’Ivoire, the BRVM is a full member of the World Federation of Exchanges (WFE) and the African Securities Exchanges Association (ASEA). Run by CEO Dr Edoh Kossi Amenounve, the BRVM has 47 listed companies and 155 bond lines. The BRVM and the Central Securities Depository /Settlement Bank (DC/BR) contribute to the improvement of long-term financing of the economies of WAEMU countries.

Over the last two decades, African stock exchanges have grown remarkably, from 16 to 29 active stock exchanges. In 2024, the total capitalisation of African stock exchanges had a combined market capitalisation of around $1.6trn.

SPONSORS AND PARTNERS

GOLD SPONSOR

SILVER SPONSORS

STRATEGIC PARTNER

MEDIA PARTNERS

MEDIA PARTNERS

2025 HIGHLIGHTS

BRVM NEWS