Speakers

Roundtable: Enhancing UK-WAEMU Cooperation for the Development of Islamic Finance, 9 April

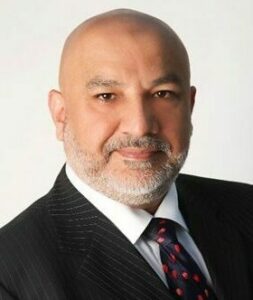

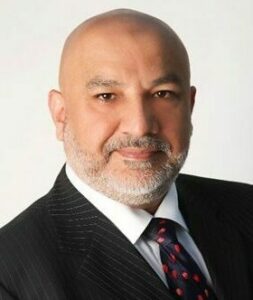

Dr Sami Assoulaimani

Founder & CEO,

Fineopolis Capital

Dr Sami Assoulaimani

Dr. Sami Assoulaimani is the Founder and CEO of FINEOPOLIS CAPITAL, a leading Islamic financial engineering and investment firm with a strong presence across Africa, Europe, and the Middle East.

With over 15 years of experience, he has been a key architect in shaping the Islamic finance landscape, particularly in Africa, by designing Sharia-compliant solutions and regulatory frameworks for governmental entities, supervisory bodies, financial institutions, and Waqf & Zakat operators.

A pioneer in Islamic financial structuring, Dr. Sami has played a crucial role in the development of Sukuk, Waqfbased capital market instruments, and Islamic refinancing models. His expertise extends beyond structuring, as he has been actively involved in capacity-building initiatives, designing and leading postgraduate programs in Islamic finance, and fostering knowledge transfer for professionals worldwide.

He serves as a member of the Regional AAOIFI Awareness and Advocacy Board and is an Honorary Fellow at the International Islamic Center for Reconciliation and Arbitration. Dr. Sami holds a Master’s in Mathematics and Economic Modelling from Paris VI and École Polytechnique, a Master’s in Law, Economics, and Finance from Nice School of Management, and a PhD in Game Theory from Université de Bretagne Occidentale.

Abdulaziz Goni

Senior Manager,

Amanie Advisors

Abdulaziz Goni

Abdulaziz Goni is a highly accomplished financial services professional with over 13 years of experience in global capital markets, fund structuring, and Islamic finance.

He currently holds the position of Senior Consultant – Global Shariah Advisory at Amanie Advisors. In this role, he specializes in structuring Shariah-compliant private equity, private credit, real estate, and venture capital funds as well as Islamic banking products and Sukuk. His client base spans Europe, the Middle East, Southeast Asia, and North America, where he has built strong relationships with sovereign wealth funds, pension funds, Investment Banks, Fund managers and institutional investors.

Adnan Halawi

Senior Proposition Manager Islamic Finance,

LSEG Data & Analytics

Adnan Halawi

Adnan Halawi is leading the product development of solutions that cater to the needs of Islamic and sustainable finance investors and professionals at the London Stock Exchange Group.

He has over 18 years of experience in developing customer-centric solutions, enabling informed investment decisions in sukuk and shariah-compliant assets, including areas of convergence between sustainable and Islamic finance. Adnan is a speaker at major conferences and the author of a wealth of articles on Sukuk and Sustainability.

He holds a Master’s in Financial Economics from the American University of Beirut, a Master’s in Digital Marketing from Instituto De Empresas Madrid and a Certificate in ESG Investing from CFA Institute.

Mohammed Mustapha Ja'afar

Transaction Legal & Structuring Analyst,

Symbiotics Group

Mohammed Mustapha Ja'afar

Mohammed Mustapha Ja’afar is a Transaction Legal & Structuring Analyst at Symbiotics Group, where he specialises in structuring, negotiating, and drafting transaction documents for capital market deals in emerging markets. With a strong focus on Islamic finance, he played a pivotal role in establishing Symbiotics' first sukuk issuance programme and has contributed to numerous green, social, and sustainability driven bond transactions.

Prior to joining Symbiotics, Mustapha served as a lawyer at The Metropolitan Law Firm in Nigeria, where he advised on landmark transactions, including the largest sovereign sukuk issuance in West Africa and the first publicly issued corporate sukuk in Nigeria. His expertise spans Debt Capital Markets, Banking, Islamic Finance, and Structured Finance, with a proven track record in deal structuring, legal risk mitigation, and transaction advisory.

Mustapha holds an MSc in Law & Finance from Queen Mary University of London, where his research focused on equity-based sukuk as Additional Tier 1 capital under Basel III. He is also a Barrister and Solicitor of the Supreme Court of Nigeria, with an LL.B from Aston University, Birmingham. A passionate advocate for innovative financial solutions, Mustapha is committed to driving sustainable and impactful investments in emerging markets. He is excited to share his insights on Islamic and sustainable finance at the upcoming conference.

Sulaiman Moolla

Managing Director, Head of Investments,

Cur8 Capital

Sulaiman Moolla

Sulaiman is an investment banker with over twenty years of experience across Treasury & Investments, Capital Markets, and Asset Management. Prior to joining Cur8, he headed Dukhan Bank’s Capital Markets, Sales & Structuring businesses. Sulaiman started his career at HSBC Amanah, HSBC’s Islamic Finance business and where he structured several first to market transactions. He has a bachelor’s degree in Physics and an MA in Islamic Finance.

Mohammad Farrukh Raza

Group CEO,

IFAAS (Islamic Finance Advisory & Assurance Services)

Mohammad Farrukh Raza

Group CEO, IFAAS (Islamic Finance Advisory & Assurance Services) Chairman, AAOIFI’s Governance & Ethics Board (Islamic Finance industry standard setting body) Co-founder, IFIN (Islamic FinTech) Co-founder, PayDay Takaful (Islamic FinTech)

Farrukh enjoys 20+ years of extensive and diverse experience in Islamic finance industry. His contribution involves leading Islamic finance projects across 64 different jurisdictions that include policy level advisory to the governments of more than 35 countries across 4 continents, building the infrastructure for Islamic finance, and playing key roles in launching ground-breaking Islamic banking, Takaful, microfinance and capital markets operations across several jurisdictions including the UK and France amongst others.

He led IFAAS team in various high-profile projects funded by Islamic Development Bank, Asian Development Bank, World Bank, International Finance Corporation and UK Government’s Department for International Development among others, establishing Islamic finance Masterplans, strategic blueprints and roadmaps, regulatory and governance frameworks for several countries including Indonesia, Kenya, Morocco, West African Economic & Monetary Union of 8 countries, CIS countries, Pakistan, Philippines and many more. He is actively contributing towards the industry’s thought-leadership through his work with the international standard-setting bodies, pushing Islamic finance to a higher degree of Shariah compliance, professionalism and inclusiveness.

His latest venture is in FinTech space where he has co-founded IFIN, and PayDay Takaful, digital solutions for Islamic finance industry.